6 November 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

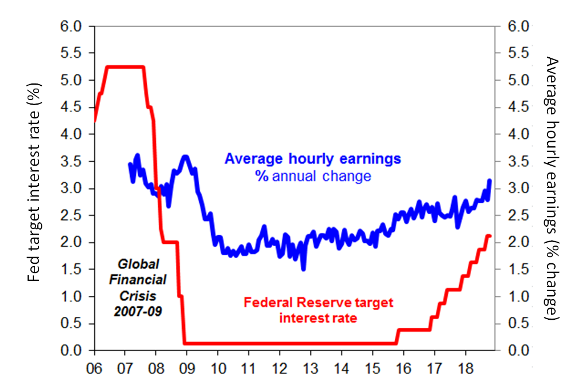

US interest rates vs wages

Source: Federal Reserve St Louis.

American workers are increasingly benefitting from a tighter labour market. Strong demand for labour has given US workers more bargaining power. October’s payroll report shows that annual wages growth is running at 3.1% (blue line). This is the largest gain in US wages in nearly ten years. So for the US corporate sector, this rising wage tide is a threat to profit margins and thereby to Wall Street.

The US Federal Reserve (Fed) has raised their key interest rate eight times since 2015 with the current setting of 2% to 2.25% (red line). The Fed has also given forward guidance that further interest rate rises should be “gradual”. This is essentially the Fed ‘telegraphing its punches’ to financial markets. However given the recent strong US jobs growth, a very low unemployment rate and wages growth accelerating, the Fed may need to punch harder on interest rates to counter US inflation pressures.

So Wall Street confronts two potential opponents that could deliver a knockout blow to investment returns. A more assertive Fed that needs to contain inflation by raising interest rates at a faster pace than the market expects. The other opponent in the ring is the US employee who recognises that there is scope to push for higher wages. Either opponent or both combined have the potential to leave Wall Street on the canvas.

Source : Nab assetmanagement November 2018

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.