How generosity can be part of your financial plan

It’s the season for gifts, sharing meals and spreading cheer. But what if your festive generosity could do more? What if it could ripple through

It’s the season for gifts, sharing meals and spreading cheer. But what if your festive generosity could do more? What if it could ripple through

Many investors breathed a sigh of relief at having survived (and even thrived) the turbulent economic and political events of 2025. Super funds posted strong

In a world of constant financial noise, from market updates and interest rate speculation to economic forecasts, it’s easy to feel overwhelmed and choose to

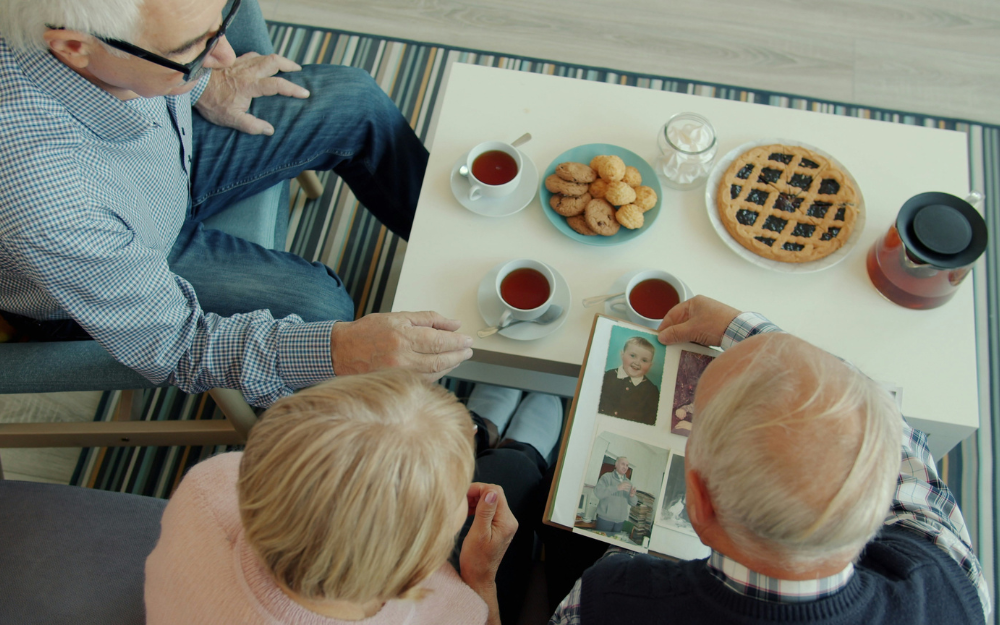

What role will an inheritance play in your long-term wealth strategy? If the ballpark numbers are at least remotely close, the amount of assets set

Ageing is a natural part of life, and with it often comes a reduced ability to manage everyday tasks, especially at night. The same is

A sudden death can place financial stress on those who depend on you. If this happens, life cover can help them pay the bills and

Few investment sectors combine geopolitical intrigue, technological innovation and long-term growth potential quite like rare earth elements (REEs). For Australians, the recent deal with the

Ready to retire… but not quite yet? We break down three reasons why a TTR pension might be worth considering. Retirement isn’t a switch you

What do Tiger Woods, Ben Stiller, Australian pensioners and dating app users have in common? Despite being from different walks of life, they have all

A simple guide for investors and pensioners Australia’s latest dividends stream was flowing strongly recently as many listed companies and exchange traded funds (ETFs) collectively

How much super should I have is a common question. But when it comes to how much super (or other savings) you’ll need for retirement

What is Lenders Mortgage Insurance (LMI)? If you’re finding it difficult to save a 20% home loan deposit, you might still be able to borrow